So the iPhone 3G S is lust-worthy, if for no other reason than the 3MP autofocus camera and the speed increase. There’s plenty of news about how AT&T is lagging – no MMS (coming), no tethering (maybe coming), giving smaller discounts to iPhone 3G customers than to new customers.

I’m not eligible for the $299 price because I’ve given Apple too much business, thus AT&T has had to subsidize me twice (read: I bought an original iPhone and a year later bought an iPhone 3G). So I get the option to wait until October to get the $299 price, or pay $499 now. I’ll wait, thanks. Maybe for whatever Apple announces next summer.

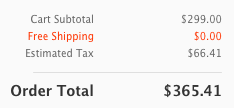

But Heidi never upgraded to the iPhone 3G, so she’s eligible for the $299 price. Great, let’s put that puppy in the cart. Whoa, look at the tax!

Yep, the tax is calculated as 9.5% (welcome to California) on the full $699 retail price of the phone. AT&T doesn’t subsidize that, and I couldn’t find it disclosed anywhere. I asked the Apple Store live chat — they were useless (told me the tax was on the $499 price) until I (duh) backed into the number on my own.

So, Apple’s ads should say the 32GB iPhone costs $699, minus an “instant rebate” that depends on how much AT&T has already subsidized you. But giving the real price wouldn’t sound as lust-worthy, would it?

Update July 18:At the online Apple Store, there’s small print at the bottom of the buy iPhone page that says

In CA, MA, and RI, sales tax is collected on the unbundled price of iPhone.

The CA regulation that requires Apple to collect this tax is documented at http://www.boe.ca.gov/pdf/pub120.pdf. What Apple doing isn’t illegal — just a bit misleading.

Totally crazy! I wanted to smack someone when I saw how much tax they added on! I guess in the end it’s all worth it. But also, the dubious upgrade fee and the increase in my plan costs with AT&T – pretty damn awful!

There is something unethical about charging you more than you expect to pay without informing you upfront. The phone is advertised for $299. Like everything else one expects to pay sales tax on top of that. Apple or ATT do not clearly disclose in ads or during in-store purchases that the total purchase price is higher than the implied advertised price.

I also live in CA and just bought one of the $99 iphones; the tax on my $99 iphone was $50! I could not believe it! The sales person who helped me said nothing about it, until I went to pay for the phone and knew 9.5% of $99 was not $50. The receipt says $99 for the iphone, and 9.5% sales tax = &50, so the total was $149. That is incorrect! 9.5% of $99 is not $50, but that’s what the receipt says! How can they get away with that, especially when the sales person(along with ads all over the store) say the iphone was on sale for $99? I do not recall any other time where I ever paid tax on the original price of a sale item, instead of paying tax on the sale price. I am filing a complaint with the Better Business Bureau! I would encourage others people who paid outrageous taxes on their iphones to do the same.

Lisa, it turns out this is the law in California. See http://www.boe.ca.gov/pdf/pub120.pdf where it states:

When the sale is a bundled transaction, the retailer must report and pay tax based on the unbundled sales price of the cell phone whether or not the price of the phone is itemized on the invoice.

Here, “bundled” applies since you bought the phone + 2 year service. if you bought the phone “unbundled” (i.e. without the service) you’ld have to pay the full (unsibsidized) price, and you’d have to pay tax too.

Then why, in Massachusetts, does the AT&T store charge sales tax on the $99 upgrade price?

This is BS. I was just on the phone with the Premier Website and the person I was talking to could not find anywhere on the Premier Website where it said that you would pay tax on the entire price of the Iphone 3GS. Then he told me to hold on and he had his entire floor look for the documentation on the website which said this and no one could find it. He pawned me off to AT&T customer care who does not even deal with the sale of IPhones so I could see about getting a refund on the extra sales tax I paid. I did not get anything and everyone at ATT totally avoids the issue about not making it apparent that you truely are not paying tax on the $199 or $299 for the Iphone. If you would like to call Premier and do your own investigating into what these crooks are doing here is thier number 866-499-8008. If the Premier people cannot even find on their own stupid website where it says you will pay sales tax on the original price of the cell phone how can they expect the average user to do so!!!???

AT&T and PREMIER are crooks and the STATE GOVERNMENT of CA are crooks as well!

-Robert Altmiller

This is true in Nevada also. The local ATT store told me when I went to buy my first i-phone. They told me I would pay tax on $500.00 retail price, not the $100.00 phone price. Guess I will look into blackberry

Debbie, it is true that they charge sales tax on the full undiscounted price in at&t store in nevada, but if you buy the iphone in apple stores in nevada they only charge sales tax on discounted purchase price. I am not sure why there is disparity between at&t and apple stores, but I will look into them.

Go to Walmart. They’ll only tax you on the amount that you’ve paid. ATT will suck you dry, the’re all about number$$$$$$. Greedy bastards!!!

This goes for refurb also. They will tax you on the $499 orginal price for a used I-Phone.

AT&T are not crooks. THEY do not get this money. Your cruddy states that charge this tax are the ones to blame.

Blame California.

The state says the retailer has to pay tax on the unbundled price not the consumer. YES, it says they can charge it…But you would think after having to sign a 2yr contract they would pay it. AT&T are penny piching overpriced assho***

So. I understand the paying full sales tax on a NEW phone whether bundled or not. But how can they do this on used re-furbished phones. The rules no longer apply since the Full tax was already paid on it once.

You fools! You are paying tax twice:

First – At time of purchase. The unbundled price is taxed.

Second – Over the cost of the subsidy via your phone bill tax.

This should be illegal.

A certain portion of your AT&T Data Charge pays down the subsidy on your shiny new phone each month.

if everyone return their iphone, you are send a strong message to the states, retailers, apple that you are the consumer. You control the market. You should know that the new iPhone is a lemon. It’s all over the news. But people still buys it. That mean, you don’t care what charges are placed on the product…rather it’s hardware or over taxed, you are to blame for wanting this item. It’s no longer a taxed or lemon issue anymore, it’s your need to want. If we let this go by, what is next? Triple taxation? Flaws on device which is okay? Sure thing Apple, make a device that loses signal because u fail to test before release…it’s okay. You will sell and I will buy. The fact is, ur the consumer. U should be smart abt what u are involved with.

It’s not just on iPhones. New Jersey, which already charges you more for car and home insurance, as well as property taxes, (highest in the nation) also tax you on the original price of items instead of the sale price. Costco’s receipt shows the original sales price, then subtract the “coupon” discount (no coupon required) and lastly the 7% tax. I inquired and was told that this is the law in New Jersey, although I clearly don’t remember previous purchases at other retailers being done this way. They should at least list it in order by putting the tax under the original price and and then taking off the discount, it would be less confusing!

This happens in Michigan too. AT & T franchises their name to other retailers. It is the other retailers (not owned by ATT) that tax this way. I got screwed and paid $48 more than I should have. Little did I know at the time that all the ATT stores were not owned by ATT. If you go to a store that is actually owned by ATT, you don’t pay that rip-off tax. The only thing these non-owned stores are doing is getting a bad name. I will no longer go to the one right by my house and will spread the word to all. The word being, if you don’t want to pay the hidden tax, go to a store owned by ATT. All you have to do is call and ask them and they’ll tell you if you get taxed extra. For some reason, ATT doesn’t tell you this anywhere. Probably because they want to open Franchises. And probably have some agreement with them not to advertise ‘no tax on actual price of phone’. So if you are in the market for an iphone or blackberry go to an ATT owned store. If I had the time, I would stand in front of the “ATT” non-owned store where I got my phone and hold a sign warning of this unfair practice. Actually I just decided to write something on facebook and mass email and spread the word to all.

Well, it is a luxury item, so why not help the government out with their debt a little in the process. I’m just glad the monthly plan isn’t 1000 – 900 in rebates. Could you imagine the tax on that every month? Crazy…

Same as everyone. I got a refurb Iphone for $99 and the tax is $53.00 … Tax is more than half price of what I am paying for.

cant believe this!

I paid the full tax in Nevada too. Iphone was 99.00 and I paid around 43. in tax.

Yea, was just about to get 4S for $199 – then boom, $50+ sales tax – screw you ATT!

Verizon, at and t, metro, and other ones do charge tax based on the original price. For example Where does the 60 tax dollars that you paid for your phone go? 10 percent of it is only the actual the tax, 50 percent is swallowed by the seller. A lot of people don’t even notice this crime and sometimes if they do the good deal on the product leads them to believe they are sill the winners.